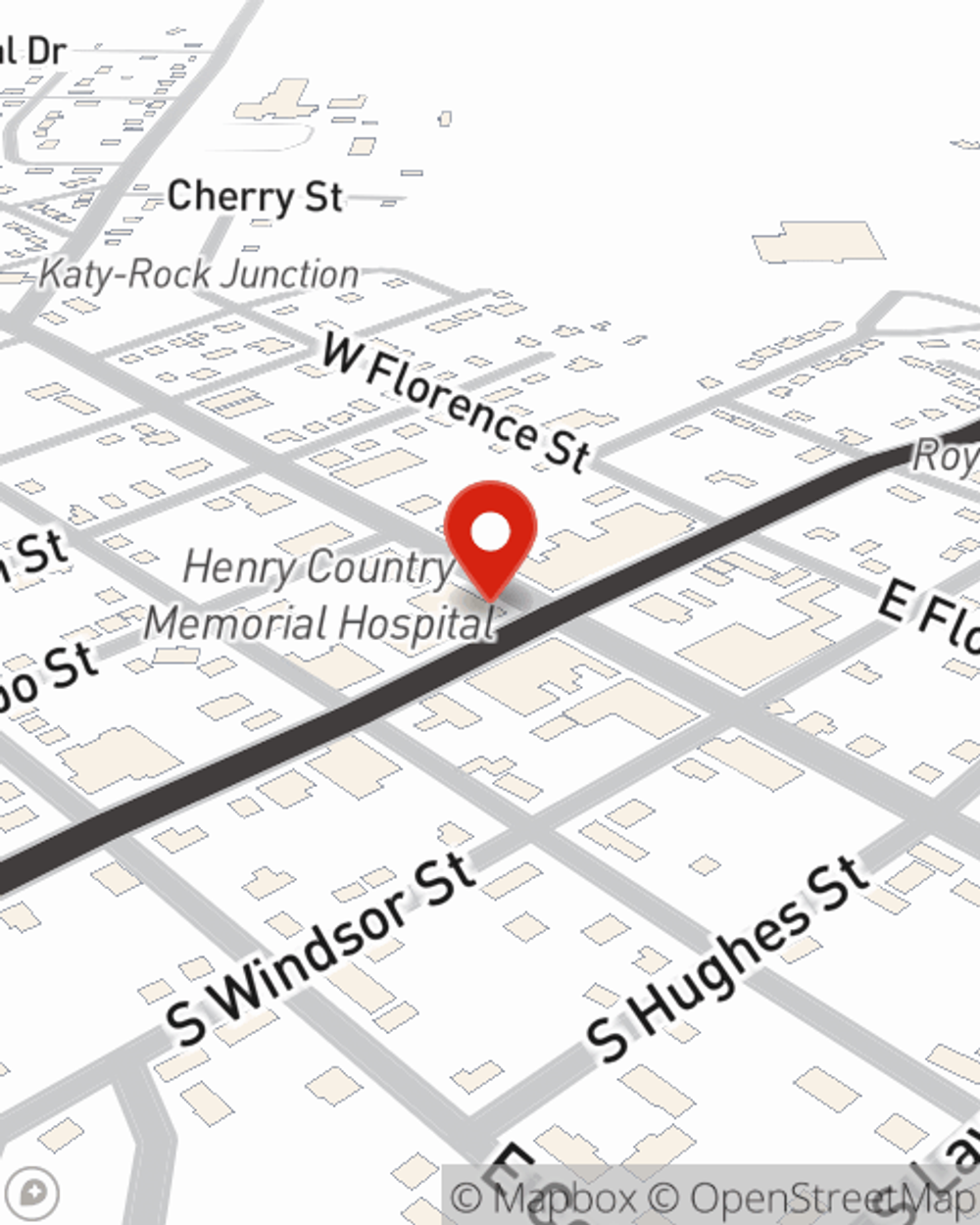

Business Insurance in and around Windsor

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Greg Frencken. Greg Frencken understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Keep Your Business Secure

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your salary, but also helps with regular payroll overhead. You can also include liability, which is vital coverage protecting your financial assets in the event of a claim or judgment against you by a third party.

It's time to reach out to State Farm agent Greg Frencken. You'll quickly notice why State Farm is one of the leaders in small business insurance.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Greg Frencken

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.